tax break refund date

Theres no penalty on a return with a refund or zero tax balance so dont delay if you want that refund. Refund depending on how late you file.

Tax Refund Deadline 2022 What Should You Know Before April 18 Marca

Travel agencies may refund the APD tax on eligible 001 tickets issued prior to December 5 2014 using one of the following three options.

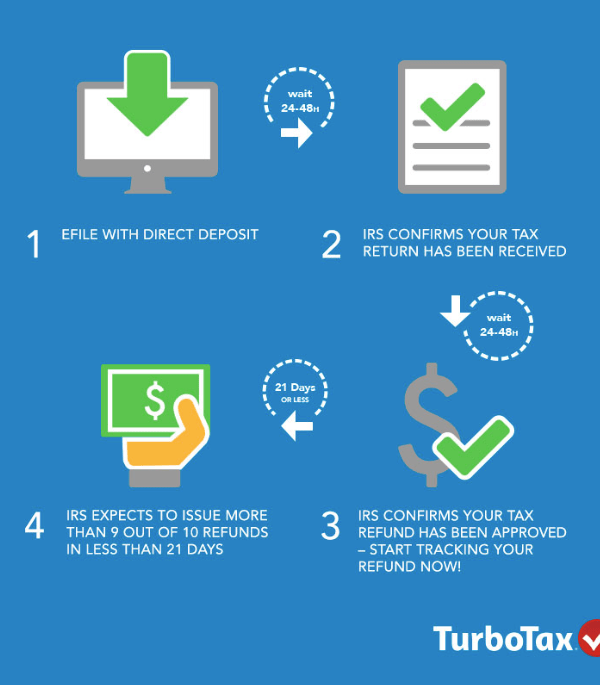

. The motor fuel tax rate for this time period is 0195 per gallon but only 0025 of that is the increased rate on which a refund may be requested. Refund of home mortgage interest. The IRS issues more than 9 out of 10 refunds in less than 21 days.

Estimate your tax refund or how much you may owe to the IRS with TaxCaster our free tax calculator that stays up to date on the latest tax laws so you can be confident in the calculations. When the moneys on its way. If people already received the 125 refund through electronic deposit they will receive the second refund.

This is an optional tax refund-related loan from MetaBank NA. If you receive a refund of home mortgage interest that you deducted in an earlier year and that reduced your tax you must generally include the refund in income in the year you receive it. This is an optional tax refund.

If you e-filed your return you can normally expect your refund about 21 days after filing. The taxpayer has paid 053 in increased motor fuel tax and may request a refund of that amount using Form 4923-H. Theres no singular reason for a tax refund delay through the IRS.

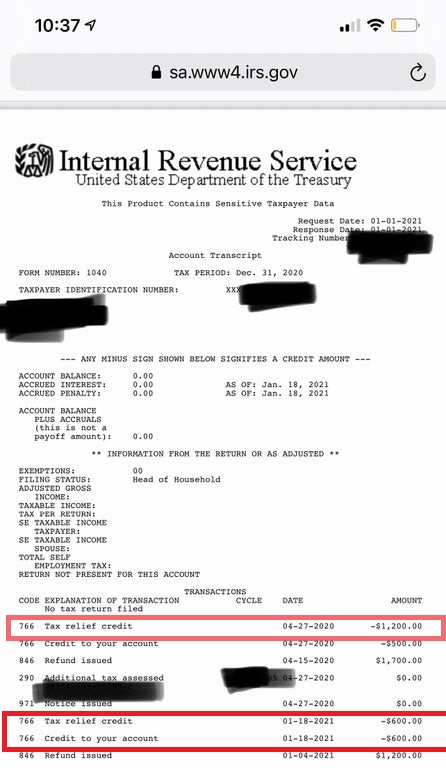

Go to IRS Cycle Codes Explained for the easiest detailed explanation to help you determine what your cycle code can tell you about your tax return and tax refund update cycle. To qualify for the refund taxpayers would have had to file an Indiana individual income tax return for 2020 with a postmark date of Jan. By using the chart below you can translate your IRS cycle code into a calendar date that tells you when your tax return posted to the IRS.

Youll need to enter the date you filed your. On or after May 1 2015 will be proactively refunded the APD tax. For more information see Recoveries in Pub.

It makes sense to choose whichever will yield you the greatest tax break but if you choose to itemize deductions youll need to keep track of your. So the earliest date taxpayers got a refund this past year was February 26 for direct deposits and March 5 for paper checks. The amount of the refund will usually be shown on the mortgage interest.

This is the highest tax refund among these scenarios. Tax refund time frames will vary. UPDATED DECEMBER 2021 for calendar year 2022.

To get your refund you have to file the return within three years of the due date. When it has approved your refund. Your tax refund comes from your 2021 return and the IRS is required to start paying interest on overpayment 45 days after accepting a tax return.

Due to federally declared disaster in 2017 andor 2018 the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. When will I get my refund. Below we break down several common reasons why your tax refund could be delayed.

An expected refund date. The taxpayer will multiply 21325 by 0025 21325 x 0025. Her tax liability before any credits would be 271.

Reasons for a Tax Refund Delay. If you mailed a paper return it can take six weeks or more for the IRS to issue a refund. You Claim Certain Credits.

Loans are offered in amounts of 250 500 750 1250 or 3500. Lets break down the reality of the situation when you have. Fastest federal tax refund with e-file and direct deposit.

In total she would be able to receive a tax refund of 7097. It is not your tax refund. Keep in mind that some circumstances can delay.

Fastest Refund Possible. She would be able to receive a 1071 American opportunity credit 800 refundable and 271 nonrefundable a 3000 refundable child tax credit and a 3297 EIC.

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

How To Track Your Tax Refund S Whereabouts Cbs News

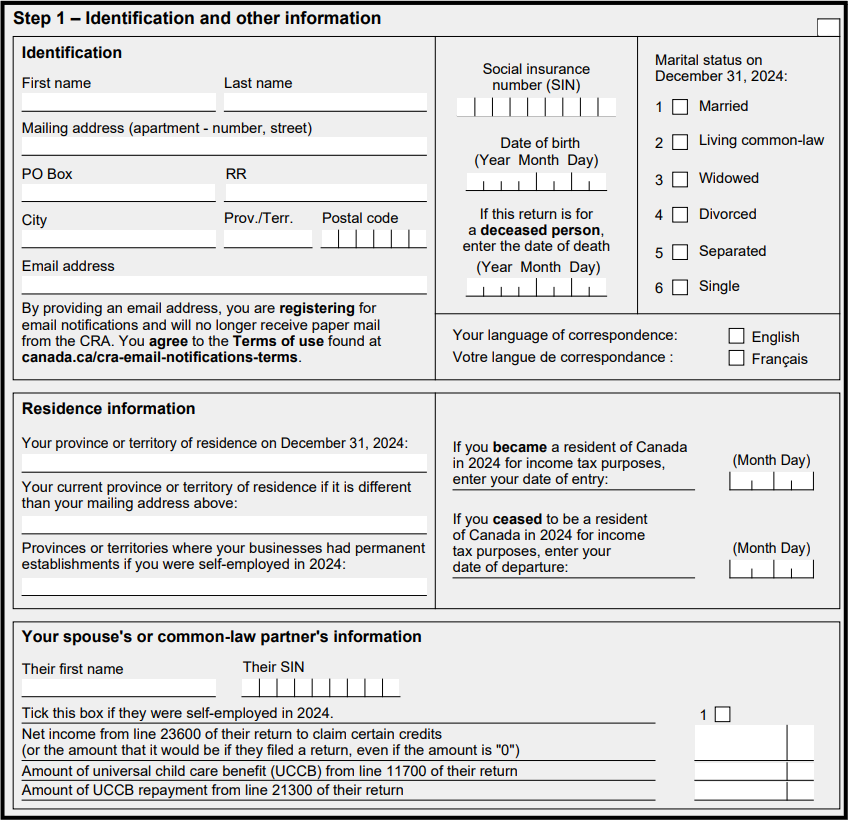

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Tax Credits How To Get A Bigger Tax Refund In Canada For 2022

When Will I Receive My Tax Refund Will It Be Delayed Forbes Advisor

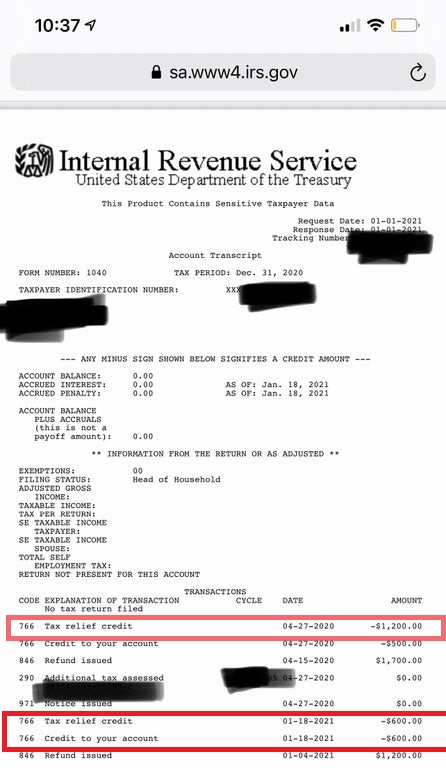

Will My Irs Tax Transcript Help Me Find Out When I Ll Get My Refund And What Does It Mean When Transcript Says N A Aving To Invest

Where S My Tax Refund How To Check Your Refund Status The Turbotax Blog

Here S How Long It Will Take To Get Your Tax Refund In 2022 Cbs News

How To File Income Tax Return To Get Refund In Canada 2022

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Child Tax Credit Schedule 8812 H R Block

How To File Income Tax Return To Get Refund In Canada 2022

The Irs Is In Crisis Taxpayer Advocate Warns Of 2022 Refund Delays

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

/GettyImages-92125643-b5c3bc0656ab41e48c59795ef5a318bd.jpg)